property tax rates philadelphia suburbs

That rate applied to a home worth 239600 the county median would result in an annual property tax. In Philadelphia the average residential tax burden declined between 2000 and 2012 from 107.

Philly Eyes Cuts To City Wage Tax Business Tax Rate Whyy

While the Philadelphia Wage Tax may be 2-4 times higher than the suburbs Philadelphias real estate taxes are.

. 307 this is a flat. Tax rates differ depending on which specific town or county youre a part of so its difficult to do a side-by-side comparison of all Philadelphia PA suburbs and all New Jersey. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

Overall Pennsylvania has property tax rates that are higher than national averages. Milford Square is a great place to live. 135 of home value Tax amount varies by county The median property tax in Pennsylvania is 222300 per year for a.

The average effective property tax rate in Philadelphia County is 098. In fact the state carries a 150 average effective property tax rate in comparison to the 107 national. For the 2022 tax year the rates are.

Pennsylvania Property Taxes Go To Different State 222300 Avg. It is close enough to all local stores safe community and a great place to raise. Property taxes are the cornerstone of local community budgets.

Most Philadelphia suburbs in PA impose a local Earned Income Tax which can be as much as 2. A Narrowing Gap between Philadelphia and its Suburbs Specifically our study found. Philadelphia Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe youre unaware that a property tax bill.

So a property with an assessed value of 500000 would owe 796950 in property taxes One thing to note is that while Philadephias property tax is 8264 mills the assessed. Philadelphia County collects on average 091 of a propertys. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as.

Now consider you live in the suburbs but also work in a Philadelphia suburb. Derek Green S Land Value Tax. Among the 100 poorest communities in the area Philadelphias tax burden declined from third-heaviest in 2000 to 59th-heaviest in 2015.

In relation to the 100 wealthiest towns Philadelphia. Property tax rates philadelphia suburbs Wednesday June 8 2022 Edit. Ranking of best places to buy a house in the philadelphia area based on home values property taxes home ownership rates and real estate statistics.

The countys average effective property tax rate is 212.

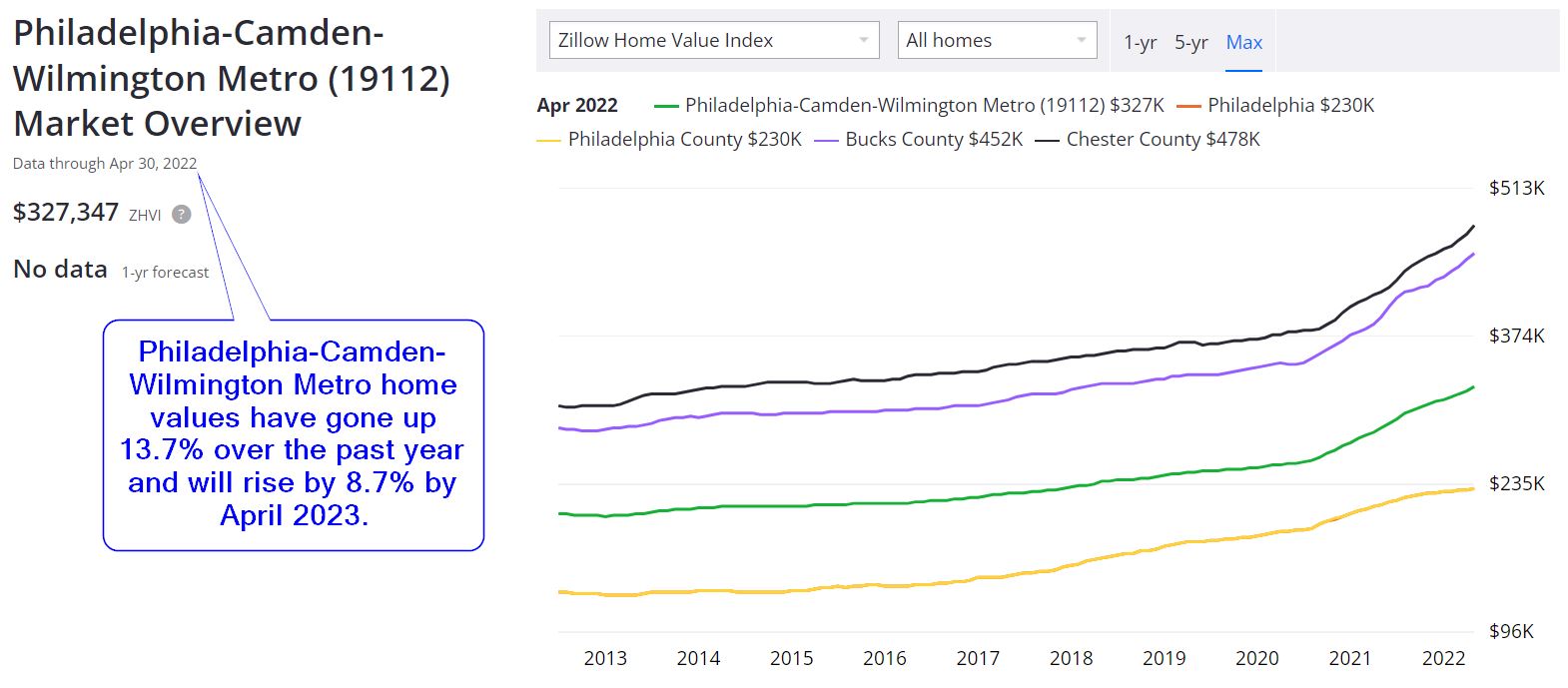

Philadelphia Real Estate Market Prices Trends Forecast 2022

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

:quality(70)/arc-anglerfish-arc2-prod-tronc.s3.amazonaws.com/public/TEIA7ZJKLFATFIMKTC6ZIMIZQI.jpg)

Even With Emanuel Hike City Homeowner Property Tax Rates Still Below Suburbs Chicago Tribune

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

5 Best Suburbs Of Philadelphia Extra Space Storage

5 Best Suburbs Of Philadelphia Extra Space Storage

6 Of The Best Philadelphia Suburbs For Commuting

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Economy League Philadelphia Budget Analysis

Philadelphia Wage Tax Cut What Does It Mean For Workers On Top Of Philly News

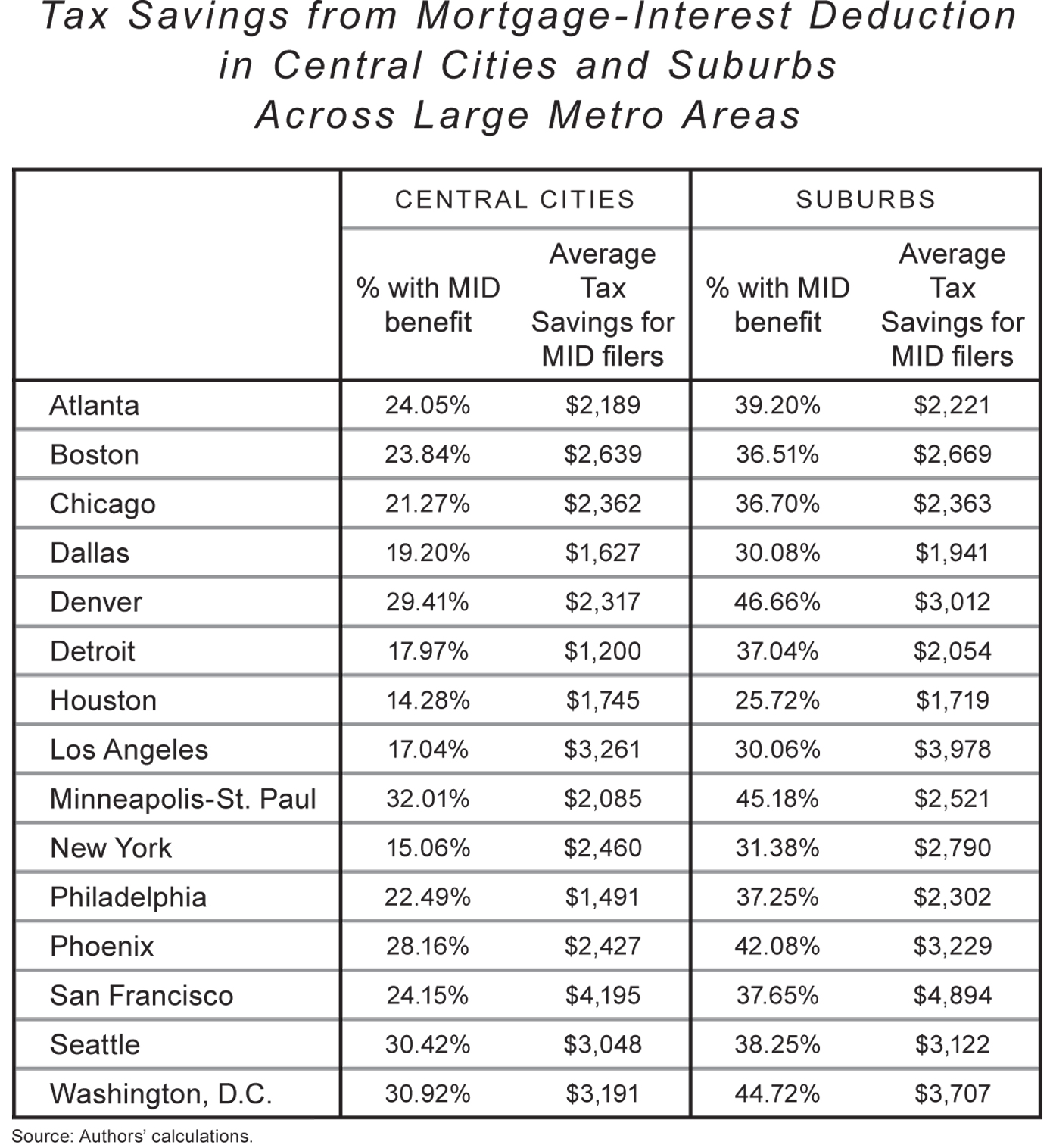

Rethinking Tax Benefits For Home Owners National Affairs

Cities Mobilize To Help Those Threatened By Gentrification The New York Times

Sparing Philadelphia Homeowners From Increasing Property Tax Burdens

Sra Suburban Realtors Alliance Municipal Database Welcome

15 Hottest Towns In Philadelphia S Western Suburbs

Pennsylvania Property Tax Calculator Smartasset

Philly S City Wage Tax Just Turned 75 Here S Its Dubious Legacy Technical Ly

Sra Suburban Realtors Alliance School Funding In Pennsylvania

Where Philadelphia Ranks Among Cities With The Fastest Growing Property Taxes In America